Can the Belt and Road go Green?

China's changing energy policy across the Belt and Road Initiative

China overseas investments have the power to transform economies. For 20 years China has been a lifeline to commodity producers, builder of countless roads, bridges and ports in emerging economies. In Europe and the US, Chinese companies have been the eager buyer of exclusive brands and hi-tech companies.

Central to China’s overseas investment policy is the Belt and Road Initiative (BRI). The Belt and Road Initiative has attracted attention, critics, fans and is China’s foreign economic policy cornerstone. Under the umbrella of the BRI Chinese firms have backed numerous new energy and power infrastructure investment projects particularly in emerging economies.

China’s New Focus

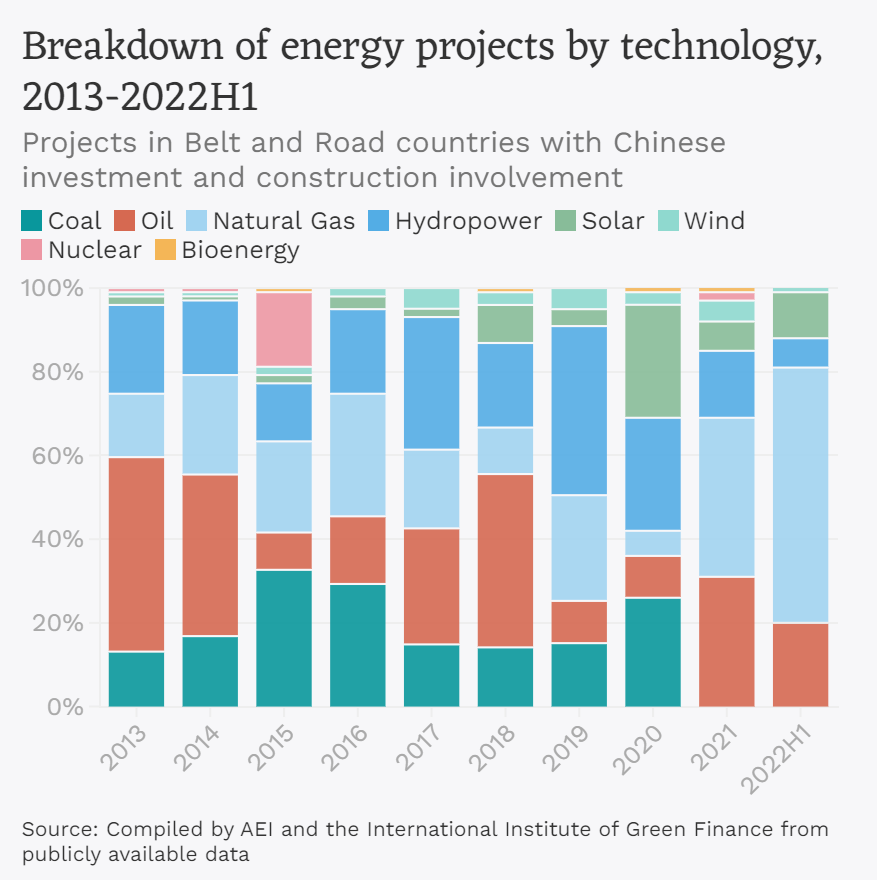

Like many countries China’s energy policy was focused around extracting and importing oil, gas and coal wherever it could find it. But in 2021 Xi Jinping announced that the BRI would no longer fund coal plants and that there would be a new focus on greening the BRI.

This surprise move steered China’s overseas energy investment policy towards renewable technology and hydro power projects. This will improve China’s reputation as a country supporting the global energy transition. Particularly as many emerging economies lack the deep pockets needed to switch to renewable technology.

The Changing Face of the BRI

Despite this move Chinese backed renewable projects across the BRI have been falling in proportion to natural gas projects. At the same time China’s overall investment in the BRI is falling. Economic problems at home further exposed by the Covid pandemic have ruthlessly undercut China’s dynamism abroad.

As China recovers, we can expect overseas investment in renewable tech and global energy transition to rise, particularly as demand for clean energy is accelerating fast. But China’s continuing dependence on fossil fuels means that a radical shift away from oil and gas is not on the cards for now.

What Comes Next?

China also wants a strong export market for its array of renewable energy and climate tech giants. This market is only going to grow. China’s renewable energy sector grew off the back off European demand 15 - 20 years ago. Now, it can ride a worldwide boom.

The US has long been the primary destination for Chinese investment, but heightened tensions between the two powers has seen new investment slump and Beijing will be wary of pushing too much money into a rival. Higher growth developing markets may be where China both invests and sells technology.

The shift to net-zero is uneven and many countries continue to invest in fossil fuels. Chinese companies will continue backing oil and gas projects as well as legacy coal projects along the BRI. But the trajectory will be clear. The Belt and Road is gradually turning green.

Will Environmental protections increase?

Chinese investment has also attracted a lot of criticism as it is perceived to run roughshod over environmental protections. Chinese investments have and continue to damage the environment, (as does much FDI). Over the last few years, the Chinese government has stepped up its oversight and adopted new rules designed to protect the environment in Belt and Road countries.

However, like many regulations there will be wriggle room and companies will doubtless find loopholes. Even if overall there is a general improvement in terms of environmental protection. Much of the power lies with recipient countries, their application of environmental regulations at a local level should be the first line of defence, rather than papers created in Beijing.

Unfortunately, many emerging economies do not have the means to apply their own laws. Underfunding, corruption or neglect can mean that Chinese (or any firm) can despoil, pollute or destroy the local environment.

Taken from a global level, environmental regulation is multiplying. International regulation on biodiversity (a process Chaired by China), growing scrutiny of global company’s supply chains, increased awareness of the damaged caused by natural resource extraction increasingly mean it is more difficult to ignore environmental protections.

Climate Risk and the Belt and Road

China’s Belt and Road ambitions face another risk. Climate risk is the threat posed by a fast changing climate. More frequent storms, floods and extreme heat are a fact of life which will increasingly cause devastation across the globe. At an economic level this means growing numbers of projects devasted by natural disasters. The 2023 floods in Pakistan created US$30 billion in damages. A country China has backed to the hilt with heavy investment and political capital.

Climate disasters will increase in size and frequency and many Belt and Road countries are particularly vulnerable. The BRI is focused on emerging economies, who have fewer resources to deal with disasters. Belt and Road projects will increasingly have to build in resilience against climate disasters for them to continue to be effective investments.

China’s energy investments overseas have the power to move the dial on climate change. Strong backing of solar and wind projects in Belt and Road countries can make serious cuts in carbon emissions. But the temptation to fund further oil and gas projects particularly in the likes of Iran, Russia and Central Asian states will remain strong.